- Home

- CompTIA Dumps

Top CompTIA Certifications

Top CompTIA Certifications

CompTIA Certification Exams

| Exam | Title | Files |

|---|---|---|

Exam 220-1101 |

Title CompTIA A+ Certification Exam: Core 1 |

Files 1 |

Exam 220-1102 |

Title CompTIA A+ Certification Exam: Core 2 |

Files 1 |

Exam CA1-005 |

Title CompTIA SecurityX |

Files 1 |

Exam CAS-004 |

Title CompTIA Advanced Security Practitioner (CASP+) CAS-004 |

Files 4 |

Exam CAS-005 |

Title CompTIA SecurityX |

Files 1 |

Exam CLO-002 |

Title CompTIA Cloud Essentials+ |

Files 4 |

Exam CS0-003 |

Title CompTIA CySA+ (CS0-003) |

Files 1 |

Exam CV0-003 |

Title CompTIA Cloud+ |

Files 4 |

Exam CV0-004 |

Title CompTIA Cloud+ |

Files 1 |

Exam DA0-001 |

Title Data+ |

Files 1 |

Exam DS0-001 |

Title CompTIA DataSys+ |

Files 1 |

Exam FC0-U51 |

Title CompTIA IT Fundamentals |

Files 2 |

Exam FC0-U61 |

Title CompTIA IT Fundamentals |

Files 5 |

Exam FC0-Z51 |

Title CompTIA IT Fundamentals |

|

Exam N10-008 |

Title CompTIA Network+ (N10-008) |

Files 7 |

Exam N10-009 |

Title CompTIA Network+ |

Files 1 |

Exam PK0-005 |

Title CompTIA Project+ |

Files 1 |

Exam PT0-002 |

Title CompTIA PenTest+ Certification Exam |

Files 1 |

Exam PT0-003 |

Title CompTIA PenTest+ |

Files 1 |

Exam SK0-005 |

Title CompTIA Server+ Certification Exam |

Files 4 |

Exam SY0-701 |

Title CompTIA Security+ |

Files 1 |

Exam TK0-201 |

Title CompTIA CTT+ Essentials |

Files 9 |

Exam TK0-202 |

Title CompTIA CTT+ Classroom Trainer |

|

Exam TK0-203 |

Title CompTIA CTT+ Virtual Classroom Trainer |

|

Exam XK0-005 |

Title CompTIA Linux+ |

Files 1 |

The files are group by the exam number. You can also see the full list of files.

About CompTIA Certification Exam Dumps & CompTIA Certification Practice Test Questions

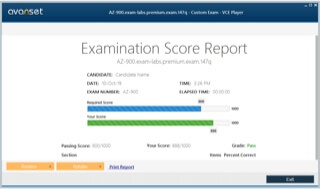

Pass your CompTIA certification exams fast by using the vce files which include latest & updated CompTIA exam dumps & practice test questions and answers. The complete ExamCollection prep package covers CompTIA certification practice test questions and answers, exam dumps, study guide, video training courses all availabe in vce format to help you pass at the first attempt.

For those who want to gain or prove their IT skills and knowledge, CompTIA offers the whole certification program with different paths that any individual can follow depending on his/her expertise. From the Entry level to the Expert one, you can experience different knowledge standards depending on what you want.

The program covers various domains, such as Cloud, Network, Project Management, Fundamentals, Security, and so on. The list is very broad, so you can go for several levels to enhance your skills. Thus, all in all, CompTIA offers the following options:

1. Core Level

There are 4 entry-level options that you can go for, and they are the following:

- CompTIA IT Fundamentals: This is the very first path to opt for when you want to understand whether you are even ready for the IT field or not. The content here covers a range of different topics related to this sector to provide you with a solid grounding of the concepts and practices that are used today by many organizations. It requires only one exam for taking, which is known as FC0-U61.

- CompTIA A+: This is the most popular certification from the program because it is a good starting point for both those specialists who are already in the industry but want to prove their foundational IT skills and those individuals who find the previous option easy but want to enter the field without any problems. It offers knowledge across a variety of operating systems and devices and gives you two tests to deal with. They are 220-1001 and 220-1002.

- CompTIA Network+: As for this path, it is the entry-level option for those who want to get networking skills and have the certificate that shows that they are able to manage, configure and troubleshoot any devices, whether they are wireless or wired. You can go for this path after you obtain CompTIA A+ if you want, it will be even easier for you to gain new knowledge. The main requirement is to pass the N10-007 test.

- CompTIA Security+: If your heart is in the security domain, you can look at this path. It covers all the needed content about identity management, cryptography, possible network threats, and other details relevant to cybersecurity. You need to pass only the SY0-601 exam and you are good to go. You can also go for this path right after CompTIA Network+ if you want to have a deeper knowledge.

Preparation Options

CompTIA offers a huge variety of prep options to help all the potential candidates learn the needed topics. It gives you the opportunity to use study guides, training courses, online learning, practice tests, and other resources. You can get what you need right on the certification webpage for each particular path. For example, for the Core level, you can use the following study guides:

- CompTIA IT Fundamentals FC0-U61 Certification Study Guide;

- CompTIA IT Fundamentals Study Guide: Exam FC0-U61 by Quentin Docter;

- CompTIA A+ Core 1 (220-1001) Certification Study Guide;

- CompTIA A+ Core 1 (220-1002) Certification Study Guide;

- CompTIA A+ Complete Study Guide: Exam Core 1 220-1001 and Exam Core 2 220-1002 by Quentin Docter;

- CompTIA Network+ N10-007 Certification Study Guide;

- CompTIA Network+ Study Guide: Exam N10-007 by Todd Lammle;

- CompTIA Security+ Study Guide by Emmett Dulaney.

All of these books can be found on the official website or on Amazon.

2. Infrastructure Level

The next track of the program includes 3 following options that cover a higher level of difficulty:

- CompTIA Cloud+: This path is ideal for those individuals who want to validate their skills in securely implementing, utilizing, and maintaining Cloud technologies. You need to have 2 or more years of experience to follow this certificate and clear the CV1-003 exam to get certified.

- CompTIA Linux+: If you are a junior-level Linux administrator or want to become one, you can opt for this option. It validates all the needed technical competencies related to Linux. You can have CompTIA A+ and CompTIA Network+ with about a year of experience as a Linux Administrator, but more importantly, you need to pass the XK0-004 test to earn the certification.

- CompTIA Server+: This is an ideal option for those who want to validate their technical knowledge and skills in performing different tasks on server platforms. It covers disaster recovery, storage, server architecture, and other details needed to become a certified professional. CompTIA recommends that you earn the A+ certificate and gain some hands-on IT experience before passing the required SK0-004 exam.

Preparation Options

The study materials are really diverse, so you can go for various options to develop a schedule that will definitely help you during your preparation phase. Thus, you can read books, register for upcoming sessions or find instructor-led courses offered by the CompTIA partners, evaluate your knowledge in virtual labs, and practice your test-taking skills with the help of the CertMaster Learn platform. Some of the books that you can use are the following:

- CompTIA Cloud+ Study Guide by Todd Montgomery;

- CompTIA Linux+ (XK0-004) Certification Study Guide;

- CompTIA Linux+ Study Guide: Exam XK0-004 by Christine Bresnahan;

- CompTIA Server+ Study Guide: Exam SK0-004 by Troy McMillan.

You can use these guides separately or alongside other preparation resources.

3. Cybersecurity Level

There are also 3 certification paths that you can find in this track. All in all, CompTIA offers the following options to choose from:

- CompTIA CySA+: Being a Cybersecurity Analyst requires responsibility because you should be able to improve the overall state of information security by applying behavioral analytics to the field. By passing the CS0-002 exam, you prove that you have all the required knowledge to perform security and monitoring operations, response to incidents, and manage possible threats. It is recommended to have CompTIA Network+ and CompTIA Security+ or their equivalents along with about 4 years of experience before going for this path.

- CompTIA CASP+: In this certification track, you will be able to validate judgment and critical thinking across a spectrum of the security disciplines used in the complex environments and prove that you have all the needed skills to become a Certified Advanced Security Practitioner. It is an expert-level certificate, so you need to be ready for getting at least 10 years of experience in the domain sector before going for the CAS-003 test. Besides that, a potential candidate needs to have 5 years of practical technical security experience.

- CompTIA PenTest+: The last option from this track is for the cybersecurity professionals who perform penetration testing tasks and manage different vulnerabilities on networks. For this path, you need to have CompTIA Network+ and CompTIA Security+ or their equivalents as well as more than 3 years of experience. PT0-001 is a qualifying exam for this option.

Preparation Options

Just like for any other CompTIA certification tracks, you can use various resources to help you prepare. The books that you can use alongside training courses, practice tests, and virtual labs are as follows:

- CompTIA CySA+ CS0-002 Certification Study Guide;

- CompTIA CySA+ Study Guide Exam CS0-002 by Mike Chapple;

- CompTIA CASP+ CAS-003 Certification Study Guide;

- CASP+ CompTIA Advanced Security Practitioner Study Guide: Exam CAS-003 by Jeff T. Parker;

- CompTIA PenTest+ PT0-001 Certification Study Guide;

- CompTIA PenTest+ Study Guide: Exam PT0-001 by Mike Chapple.

4. Additional Professional Level

At this additional level, you can opt for the following certifications:

- CompTIA Project+: To get this certification, you need to be able to perform all the required actions with the project you are working on. Thus, you should have the skills in managing projects or business initiative and complete them according to the set requirements, time, and budget. If you have 12 or more months of project management experience, you will be able to pass the PK0-004 test without any problems.

- CompTIA CTT+: The key idea of this path is to turn you into a certified trainer who has all the required knowledge to use the appropriate techniques and tools in today’s learning environments. There are three exams in total, and you need to pass two of them. Thus, you should clear TK0-201 and then choose between TK0-202 and TK0-203. The recommended experience includes 6 or more months of the instructor experience.

- CompTIA Cloud Essentials+: This certification is available for both the non-technical and IT specialists who want to make informed Cloud service decisions. It will show that they know about the technical components that are included in any Cloud assessment and understand the foundational business components. There is only one exam that you need to deal with, and this is CLO-002.

Preparation Options

CompTIA has all that you need even for this additional certification track. Of course, there are a lot of training options that you can go for. You can find them on the official website or on the platforms of the CompTIA partners. The guides that you can use for these paths are the following:

- CompTIA Project+ Study Guide: Exam PK0-004 by Kim Heldman;

- CompTIA CTT+ Certified Technical Trainer All-in-One Exam Guide by Joseph Philips;

- CompTIA Cloud Essentials CLO-002 Certification Study Guide;

- CompTIA Cloud Essentials+ Study Guide: Exam CLO-002 by Quentin Docter.

Career Opportunities

The CompTIA certifications open doors to a variety of job opportunities that you can go for. These include different career paths, such as the following:

- Office Productivity;

- Training;

- Software Development;

- Information Security;

- Network and Cloud;

- IT Network Administration;

- Security Analytics;

- Cybersecurity;

- Java Development;

- Desktop Analytics.

CompTIA opens the road to a more enhanced and prosperous IT career, which means that you can get a promotion or a higher salary. It all depends on the path you choose, so you can surely have an average salary of about $53,000 to $100,000 per year.

Latest questions and answers in vce file format are uploaded by real users who have taken the exam recently and help you pass the CompTIA certification exam using CompTIA certification exam dumps, practice test questions and answers from ExamCollection. All CompTIA certification exam dumps, practice test questions and answers, study guide & video training courses help candidates to study and pass the CompTIA exams hassle-free using the vce files!

CompTIA Video Courses

Site Search:

I passed, and I passed, and I passed! There can not be a better resources than this medium. Guys, study hard and spend some some here(take a loan if you don't have money). With hard work/study, this is really a key to success.

Thank you guys. I passed!!!

I can't believe it! I have managed to pass my CompTIA exam with flying colors! I am more than content about the quality of the premium files for the 220-1001 exam.

The files on this site are valid indeed. I passed the simulation test for the CompTIA A+ (220-1001) exam and got 54% on the first attempt and 97% on the second. I think I am now able to pass the real exam, because I tried to learn all the topics in details. Thanks a lot, ExamCollection, for the help!

I personally think that the SY0-601 exam is really tough, and it is impossible to pass it without the detailed preparation. That is why I thought that it would be better to get the prep materials from different sources and in various types. Thus, I bought an official CompTIA guide, found some flashcards, and bought the premium files alongside the VCE simulator. I had been preparing for several weeks, so I hope I will do my best tomorrow.

The files on this site are valid indeed. I passed the simulation test for the CompTIA A+ (220-1001) exam and got 54% on the first attempt and 97% on the second. I think I am now able to pass the real exam, because I tried to learn all the topics in details. Thanks a lot, ExamCollection, for the help!

At first, I was wondering how to open the files from the bundle, but then I saw that there is a VCE exam simulator, which you can use to test your skills. I was pleasantly surprised that there is an opportunity to create your own practice test with these files and apps. I will start my preparation next week and hope that it will be a useful and interesting experience.

Add Comment

Feel Free to Post Your Comments About EamCollection VCE Files which Include CompTIA Certification Exam Dumps, Practice Test Questions & Answers.